Gender and poverty-related barriers of the urban poor to access climate and disaster risk finance and insurance: evidence from the Mahila Housing Trust in India

Climate change is predicted to have a significant impact on global poverty levels. According to a World Bank report, climate change is projected to push up to 132 million additional people into extreme poverty by 2030. This is due to the fact that many of the people who are living in poverty are also the ones who are most vulnerable to the impacts of climate change. A recent global study, demonstrates that women are three to four times more vulnerable to climate-related disasters than men, with the prevailing evidence indicating that gender differentiation is based on historical and existing inequalities and discriminatory norms rather than biological sex.

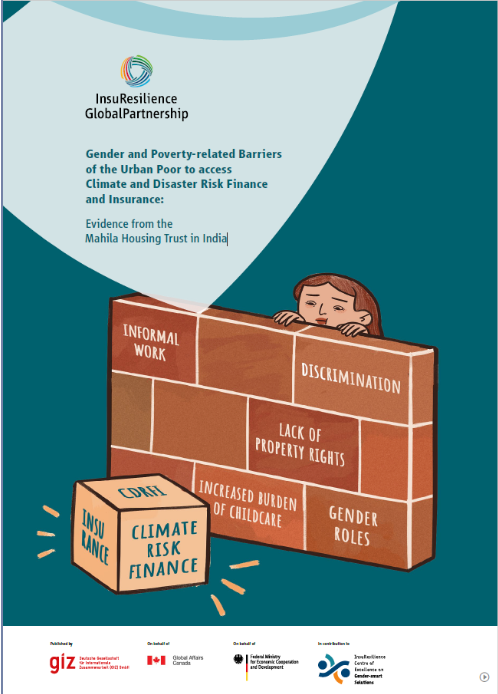

Climate and Disaster Risk Finance and Insurance (CDRFI) solutions can play an essential role in coping with and adapting to climate change, enabling governments, businesses, and individuals to protect their financial security in the event of shocks, and to provide information and incentives for improved risk management. However, socio-economic differences and cultural norms play a role in providing access to CDRFI solutions. As a result of discriminatory gender roles, women face lower rates of financial inclusion and less access to financial instruments.

To understand how CDRFI approaches can be appropriately designed and effectively deployed to reach this segment, there is a need to take a closer look at the complex conditions of poverty. In particular, a closer gender-differentiated look at how living in financially constrained conditions affects the behaviour and decision-making of poor and vulnerable people would help to inform the design of CDRFI solutions.

The findings of this study are intended to inform and enable the adoption of gender-responsive disaster risk financing and insurance approaches as part of comprehensive climate and disaster risk management strategies. The study particularly targets policy makers and practitioners from governmental institutions, civil society, international organizations, academia, insurance authorities and the private sector, who are involved in the research design and implementation of Climate and Disaster Risk Financing and Insurance.

This study is based on evidence from the grassroots organization Mahila Housing SEWA Trust in India. For its findings, interviews were conducted with the organization’s staff and urban poor women groups to include their first-hand experiences in dealing with climate risk into recommendations for designing gender-responsive CDRFI solutions.